LB SANMITHA is an integrated MSME -focused financial product suite developed under the LBF brand, specifically tailored to serve the evolving needs of micro, small and medium-scale entrepreneurs in Sri Lanka. This initiative recognizes the critical role played by MSMEs in national economic development, contributing over 50% to employment and significantly to the Gross Domestic Product (GDP).

- The suite consists of:

- LB SANMITHA Savings Account

- LB SANMITHA Gold Loan LB SANMITHA Business Loan

- LB SANMITHA Knowledge Platform

The overarching goal of LB SANMITHA is to uplift the economic life cycle of Sri Lankan entrepreneurs by offering accessible, affordable, and growth-oriented financial services.

"LB Sanmitha" This name reflects the core mission of LB Finance: to act as a balanced financial partner for micro, small and medium-scale enterprises across Sri Lanka.

Meaning: "Good Friend" or "Noble Companion" (From Sanskrit: “San” = good, noble; “Mitha” = friend)

LB Sanmitha represents more than a financial product — it embodies a relationship of trust, growth, and enduring support. Just like a good friend who stands by your side, LB Sanmitha evolves with the entrepreneur, from humble beginnings to thriving business success.This name reflects the core mission of LB Finance: to act as a balanced financial partner for small and medium-scale enterprises across Sri Lanka.

How “Sanmitha” Relates to the MSME Sector and LBF’s Vision:

- Nurturing : Supports micro-level financial needs such as initial savings, startup capital, and short-term loans.

- Progressive : Grows into offerings like MSME business loans, working capital finance, and savings deposits as the customer expands.

- Relational : Built on empathy, understanding, and long-term companionship — not just transactional engagement.

By choosing the name "LB Sanmitha", LBF reaffirms its commitment to harmonious, ethical, and sustainable financial support, building a future where MSMEs are not only funded, but truly understood, guided, and grown.

Want to know more?

Contact us today

Contact us today

Following eligibility requirements apply for clients seeking access to Savings Accounts, Gold Loans, Business Loans, Digital Financial Services, Potential Markets, Knowledge and Training:

A. APPLICANT PROFILE

- Age : Must be 18 years or older

- Business Status : Actively engaged in an entrepreneurial activity in Sri Lanka

- Gender & Inclusivity : Open to all genders with a special focus on women-led MSMEs

B. BUSINESS VERIFICATION AND REGISTRATION

- Registered Businesses : Must submit a valid Business Registration (BR)

document

- Unregistered Businesses:

- BR is not mandatory for eligibility under LB Sanmitha

- In the absence of BR:

- Customer must be verified through local authority records and/or internal investigations

- The objective is to validate the presence of a genuine MSME operation

- Support for BR Acquisition :

- Where BR is required or pending, support will be facilitated through NEDA (National Enterprise Development Authority)

- Unregistered Businesses:

C. SECTORAL ELIGIBILITY

Businesses must operate in one or more of the following eligible sectors under LB Sanmitha :

- Manufacturing

- Agriculture

- Technology

- Tourism

- Export-oriented sectors

- Services

- Includes businesses providing value-added services such as hospitality (restaurants), professional consulting, skilled repair services, creative services (design, printing), education and training, healthcare practices (private clinics, physiotherapy centers), and personal care services (salons, wellness centers). Pure trading or resale businesses without value addition are excluded

D. BUSINESS SCALE CRITERIA

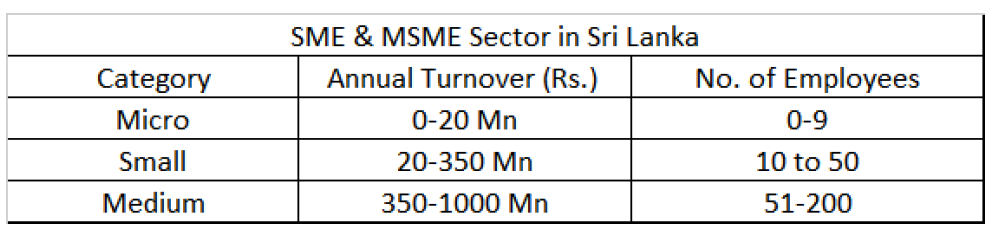

- Turnover Threshold: Annual turnover must be less than LKR 1.0 Billion

- Employee Count: Must employ fewer than 200 individuals

As per national definitions, LB Sanmitha focuses primarily on Micro and Small Enterprises, although Medium Enterprises may be considered on a case-by-case basis.

E. NON-ELIGIBLE ACTIVITIES The following business types are excluded from LB Sanmitha :

- Trading : Defined as purchasing finished goods/services and reselling them without any form of value addition

- Leasing & Renting : Pure leasing or renting activities without direct economic value generation

- Negative Lending List : As per LB Finance policy, clients listed on the negative Lending list are not eligible for LB Sanmitha product. Additionally, individuals or entities engaged in the manufacture, distribution, or sale of alcohol, tobacco, or related products are also ineligible

Key Highlights of NCGI

- Loan Coverage : Eligible loan amounts range from Rs. 500,000 to Rs. 25,000,000.

- Guarantee Mechanism : NCGI provides a credit guarantee covering up to 67% of the principal outstanding. This helps mitigate credit risk for LB Finance while ensuring better access to funding for MSMEs.